| BYD has transformed from a battery maker into the world’s top EV seller, surpassing Tesla with innovation, vertical integration, and global expansion. |

A decade ago, Tesla was synonymous with electric cars, symbolizing innovation and disruption. But today, a new titan has emerged from the East:

BYD Company Ltd. – Build Your Dreams

A once-modest battery manufacturer from Shenzhen that has transformed into the world’s largest electric vehicle maker.

With its roots in rechargeable batteries, BYD has redefined the auto industry through vertical integration, breakthrough technology, and an aggressive global expansion strategy.

Its rise is not just a corporate success story, it’s a reshaping of the global automotive order. BYD has executed one of the most stunning corporate transformations of the 21st century, evolving from a niche player into the world’s largest seller of electric vehicles.

In this article, we will dive into the strategy, data, and disruptive vision behind BYD’s storming rise on the global stage.

Humble Beginnings- The Battery Foundation (1995-2007)

BYD’s story didn’t start with cars. Founded in 1995 by chemist Wang Chuanfu, the company’s initial goal was to challenge Japanese dominance in rechargeable batteries for consumer electronics.

By leveraging cheaper labor and innovative, semi-automated production processes, BYD quickly became a top supplier for giants like Nokia and Motorola.

This early mastery of battery chemistry and large-scale, cost-effective manufacturing is the bedrock upon which BYD’s entire auto empire is built. While others had to source batteries, BYD owned the core technology from day one.

| India BYD entered the Indian auto market in 2016 by supplying batteries and bus chassis to Olectra Greenwich Ltd. Its factory is located in Sriperumbudur, Tamil Nadu. In 2022, BYD began assembling electric passenger cars in small numbers through a semi-knock down process. The first models assembled were the e6 (from September 2022) and the Atto 3 (from November 2022). |

The Inclination to Automobiles and Early EVs (2003-2019)

In 2003, BYD acquired Qinchuan Automobile Company, a struggling state-owned manufacturer, marking its official entry into the auto industry.

Its first cars were inexpensive internal combustion engine (ICE) vehicles, heavily inspired by, and often criticized for mimicking, established models like the Toyota Corolla.

The real visionary move came in 2008 with the launch of the F3DM, the world’s first mass-produced plug-in hybrid electric vehicle (PHEV). While it had limited success, it showcased BYD’s unique approach: vertical integration. They controlled the battery, motor, and electronic control systems, the “core three” of an EV.

A major turning point was a $232 million investment from Warren Buffett’s Berkshire Hathaway in 2008. This vote of confidence provided not just capital but immense global credibility.

The Perfect Storm: Strategy and Market Forces (2020-Present)

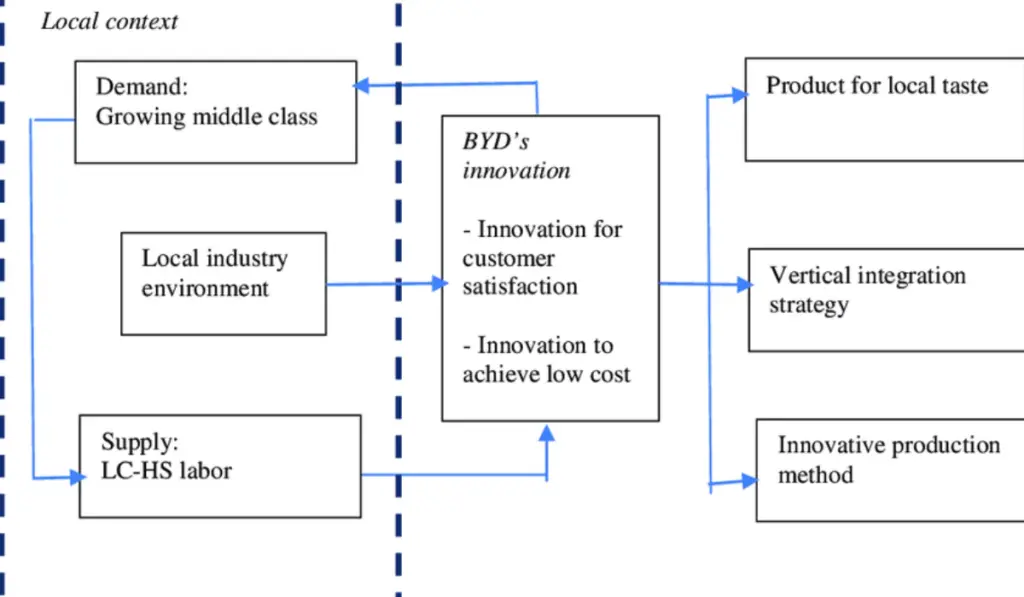

BYD’s explosive growth is not an accident. It’s the result of a perfect alignment of its strategy with powerful external forces.

The Blade Battery (2020): A Game-Changer in Safety

BYD’s proprietary Blade Battery revolutionized EV safety. Its unique cell-to-pack design offered:

- Exceptional Safety: It passed the rigorous nail penetration test without catching fire or exploding.

- Higher Energy Density: Allowed for longer range on a single charge.

- Cost Reduction: Simplified production and used cheaper, safer Lithium Iron Phosphate (LFP) chemistry.

This technology became the heart of every subsequent BYD model, a compelling unique selling proposition.

Vertical Integration: The Ultimate Competitive Moat

While other automakers rely on a complex web of suppliers, BYD produces up to 75% of its components in-house, including:

- Batteries (the most expensive component)

- Electric motors

- Semiconductors (through its subsidiary BYD Semiconductor)

- Infotainment systems

This control shields them from supply chain shocks (like the global chip shortage) and allows for relentless cost optimization.

Dominating the Chinese Market: The Springboard

BYD astutely read the Chinese government’s strong push for EV adoption through subsidies and regulatory mandates. It flooded the market with a “car for every segment”:

- Entry-Level: Seagull (Dolphin in some markets)

- Family SUV: Song Pro / Atto 3

- Executive Sedan: Han

- Luxury: Yangwang U8

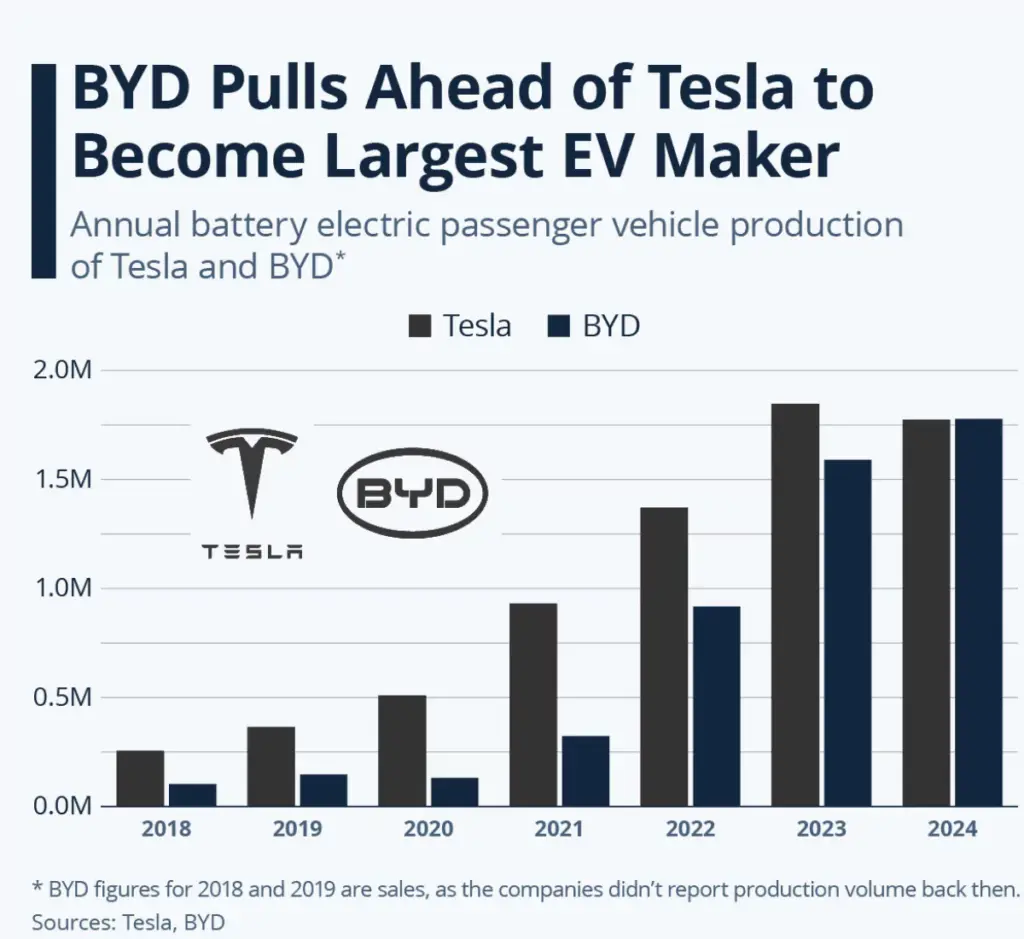

In Q4 2023, BYD surpassed Tesla to become the world’s top-selling EV maker, moving 526,409 all-electric vehicles to Tesla’s 484,507. For the full year 2023, it sold over 3 million new energy vehicles (NEVs), a mix of BEVs and PHEVs.

Going Global- The Next Frontier

Having cemented its dominance in China, BYD is now executing a rapid and aggressive global expansion strategy.

- Europe: Models like the Atto 3 (SUV), Han, and Tang are being sold across key markets like Germany, Norway, and the UK, directly competing with VW and Tesla.

- Southeast Asia & Australia: BYD is a dominant force in Thailand’s EV market and is growing rapidly in Australia.

- The Americas: While facing political headwinds in the US, BYD is focusing on Latin America and has a strong presence in buses and commercial vehicles in North America.

BYD’s overseas NEV sales surged by 333% in 2023, selling over 240,000 units outside China, proving its models have global appeal.

| By 2025, BYD is targeting sales of 5-6 million vehicles, with nearly half expected to come from overseas markets, according to Stella Li, CEO of BYD Americas. In a statement from November 2023, Li highlighted the company’s commitment to quality, noting that while innovative technologies often face challenges, BYD remains dedicated to delivering top-tier safety and performance. |

Read Also: Why BYD is Outselling Tesla in Europe

Challenges Ahead

BYD’s path is not without obstacles:

- Geopolitical Tensions: Tariffs and political resistance in markets like the US and EU could hinder growth.

- Brand Perception: Building a premium, global brand to rival Tesla or Mercedes takes time and is about more than just price.

- Intense Competition: Chinese rivals (NIO, XPeng) and legacy automakers (VW, GM) are pouring billions into their own EV transitions.

BYD is More Than Just a Car Company

BYD’s journey is a masterclass in strategic foresight and vertical integration.

It’s not merely a car company; it’s a technology conglomerate that leveraged its core competency in batteries to disrupt the entire automotive industry.

By controlling its destiny from the mine to the microchip, BYD achieved scale, safety, and affordability that the market is struggling to match.

The global auto industry is no longer a Western-dominated arena.

BYD has stormed the stage, and its relentless innovation and strategic expansion suggest that its journey from underdog to titan is far from over.

The race for EV supremacy is on, and BYD is currently in the lead.